The enterprise value formula provides a comprehensive snapshot of a company’s overall worth. It is calculated by combining the company’s market capitalization with its debt, subtracting its cash and cash equivalents.

This calculation considers various financial aspects to give a more accurate representation of the company’s value.

This metric or KPI is pivotal for assessing a company over time, establishing fiscal targets, making informed decisions, and evaluating potential acquisitions.

The enterprise value formula is also used when considering alliances and joint ventures, corporate bond issuance, international public offerings (IPOs), banking credit, portfolio management, risk evaluation, and occasionally top-management bonuses.

This formula can help create a fair company valuation that aligns with well-established and widely accepted systematic appraisal methods.

But why factor in debt and cash in a company’s valuation?

When acquiring a company, the buyer pays the equity value, often set above the market rate in mergers and acquisitions. Additionally, the buyer assumes the company’s debts.

However, they also inherit the company’s cash, justifying its subtraction from the valuation.

This is why it is important to include debt and cash in a company’s valuation to ensure fairness.

By the end of this article, you will know:

- What an enterprise value and its associated formula

- An enterprise value formula example

- What does an enterprise value formula tell you

- Why an enterprise value matters for your business

- The difference between an enterprise value, market cap, and a P/E ratio

- How to use enterprise value as a valuation multiple

- The limitations of enterprise value

- How you can demonstrate that you understand enterprise value on your resume

What Is Enterprise Value (EV)?

Enterprise value (EV) captures the holistic worth of a company in financial terms. This value encompasses the market capitalization, which is the going rate of its shares, and its net debt, which factors in its liabilities and cash on hand.

By amalgamating these numbers, the enterprise value paints a picture of the approximate amount one would need to acquire the company.

In essence, when considering enterprise value, you’re looking at the sum needed to satisfy all the stakeholders with a financial claim in the company.

This includes compensating equity holders or shareholders and settling any outstanding debts to lenders. If you were to purchase the company, you would need to cover the cost of its shares and be obligated to clear its debts.

Upon acquisition, the company’s cash reserves come into your hands. This accessible cash effectively reduces your acquisition cost, explaining why, in determining the value of a company, one adds the debt but deducts the cash.

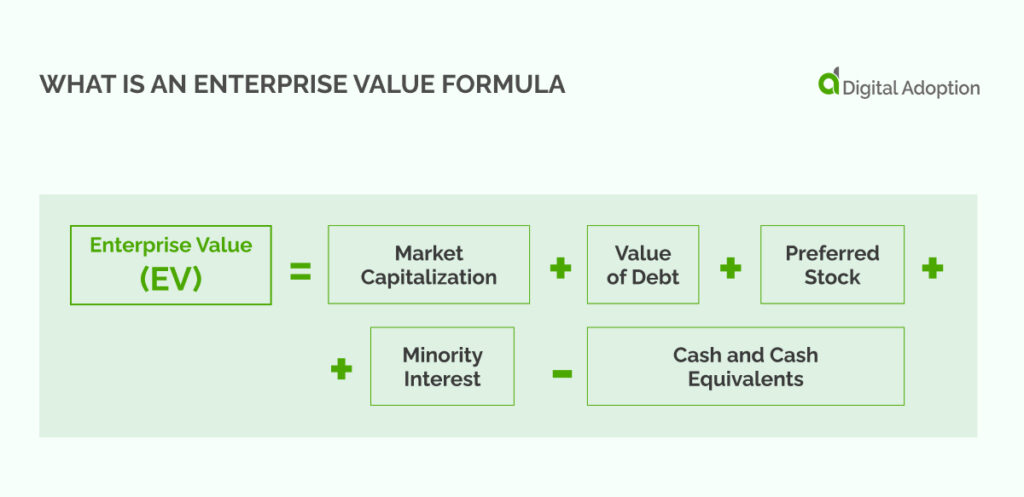

What Is An Enterprise Value Formula

A company’s enterprise value (EV) provides a comprehensive snapshot of what it would cost an investor to buy the entire company outright. Essentially, it represents the complete takeover price. To determine this, one can use the enterprise value formula:

Enterprise Value (EV)=Market Capitalization+Value of Debt+Preferred Stock+Minority Interest−Cash and Cash Equivalents

The components involved in the EV calculation are:

Market Capitalization

This is the aggregate value of a company’s outstanding common and preferred shares.

Value of Debt

This encompasses both long-term debt and short-term debt obligations.

Preferred Stock

These shares have a higher dividend claim than common stock.

Minority Interest

This accounts for the value of a subsidiary in which the company owns less than 50% stake.

Unfunded Pension Liabilities (if applicable)

This represents the amount a company is short of to meet pension commitments or the funds that need to be set aside for pension disbursements in a plan that isn’t pre-funded. If this figure is available, it can be added to the market capitalization.

Cash and Cash Equivalents

These are liquid assets like money market funds, short-term government bonds, commercial paper, drafts, and others that can be quickly converted into cash. Since acquiring a company means gaining its cash reserves, this amount is subtracted to reflect the net cost to the buyer.

Enterprise Value Formula Example

Consider a hypothetical company, ABC Limited, with the following financial details:

Shares Outstanding: 3,000,000

Current Share Price: $4

Total Debt: $2,000,000

Total Cash: $1,000,000

From the information provided:

Market Capitalization = Shares Outstanding × Current Share Price

= 3,000,000 × $4

= $7,000,000

With no Preferred Stock and no Minority Interest stated, their values are $0.

Outstanding Debt = $5,000,000

Cash and Cash Equivalents = $1,000,000

To calculate enterprise value, use the EV formula:

EV=MarketCapitalization+PreferredStock+OutstandingDebt+MinorityInterest–CashandCashEquivalents

Enterprise Value = $7,000,000 + $5,000,000 – $1,000,000

= $11,000,000 or $11 million.

Who Can Use An Enterprise Value Formula?

In mergers and acquisitions, financial experts, especially investment bankers, can use an enterprise value as a yardstick to evaluate companies, assisting their clients in making informed decisions about potential acquisitions or mergers.

Beyond the M&A landscape, EV is also a cornerstone metric in various other financial and accounting calculations.

For instance, it can be paired with indicators such as EBITDA to derive ratios that offer a nuanced perspective on company value, facilitating more comprehensive business comparisons.

Why Does Enterprise Value Matter For Businesses?

An enterprise value is important for businesses and is an invaluable instrument for gauging a company’s size and comprehending how it leverages debt.

For instance, certain burgeoning tech stocks might appear excessively valued when solely assessed through market capitalization.

However, accounting for minimal or non-existent debt and subtracting a substantial cash reserve may reveal that the enterprise value provides a starkly distinct valuation compared to mere market cap.

Enterprise Value Vs. Market Cap

Market capitalization doesn’t wholly capture a company’s worth because it overlooks key components like debt and available cash.

By accounting for these factors, enterprise value offers a more holistic view, thus presenting a clearer picture of a company’s value.

Although they seemed identical when evaluated solely on market cap, their enterprise values reveal a distinct disparity in their overall worth.

Enterprise Value Vs. P/E Ratio

The price-to-earnings ratio (P/E ratio) is a valuation metric that relates a company’s current share price to its earnings per share (EPS). Sometimes known as the earnings or price multiple, the P/E ratio doesn’t account for a company’s debt.

In contrast, the Enterprise Value (EV) encompasses a company’s debt, providing a more holistic valuation. To obtain a well-rounded assessment of a company’s worth, the P/E ratio and enterprise value are often considered together.

Using Enterprise Value As A Valuation Multiple

Enterprise value (EV) is a foundation for various financial metrics that gauge a company’s performance.

One such metric is the enterprise multiple, which connects the company’s entire valuation from all funding sources to its operational earnings, represented by earnings before interest, taxes, depreciation, and amortization (EBITDA).

EBITDA gives insights into the revenue drivers of a company as an alternative to straightforward earnings or net income in specific scenarios:

EBITDA = Net Income + Interest Expense + Taxes + Depreciation + Amortization

However, EBITDA might not always provide the complete picture since it omits the capital costs related to assets like property and equipment.

When working capital inflates, EBITDA might exaggerate cash flows from operations. Additionally, it overlooks the impact of different revenue recognition policies on a company’s operational cash flow.

Another popular valuation metric is the EV-to-sales ratio (EV/Sales). This ratio is more precise than the Price/Sales metric because it accounts for a company’s value, including the debt it must repay.

A lower EV/Sales ratio suggests a company might be undervalued. In unique cases where a company’s cash surpasses its market cap and debt, the EV/Sales ratio can be negative, signifying it can settle all its obligations.

Enterprise Value Limitations

Enterprise value (EV) has limitations, especially when comparing companies operating in different sectors or growth stages.

While EV gives a comprehensive view of the overall cost to acquire a company, considering factors beyond just market capitalization, it may not always provide a complete perspective on a company’s financial performance or health.

For instance, two companies might have identical market caps, but if one is laden with debt. At the same time, the other boasts substantial cash reserves; the latter would naturally be more economical to acquire. But this only tells part of the story.

Debt utilization varies across industries. A software firm heavily in debt with limited cash might seem less appealing than a debt-free firm with a similar market cap.

However, the narrative changes when you compare companies across industries. Capital-intensive sectors like utilities or automobile manufacturing often require sizable debt to fund the necessary assets for revenue generation.

Furthermore, the growth stage of a company affects its EV. Startups or companies experiencing rapid growth might not have accumulated as much debt as their mature counterparts.

Therefore, although the enterprise value formula provides valuable insights into a company’s worth, it is crucial to consider the industry landscape, growth stage, and debt utilization when making investment choices.

How To Show You Understand Enterprise Value On A Resume

When showcasing a knowledge of calculating enterprise value in your resume, consider the following points:

- Skills Section: Under your skills or expertise area, highlight your proficiency in business valuation techniques. You might list “Enterprise Value (EV) Assessment” to showcase your knowledge.

- Work or Internship Experiences: Detail your practical experience with EV in the descriptions of relevant positions. For instance: “Conducted comprehensive business valuations for multiple firms, employing techniques such as Enterprise Value.”

Next Steps For Enterprise Value

Enterprise value (EV) provides a fuller assessment of a company’s total worth and is often utilized by businesses contemplating mergers or acquisitions.

Enterprise value offers a broader perspective on a company’s value than merely its market capitalization (market cap), which solely reflects the total market value of all outstanding shares.

Market cap might give an idea of how the stock market values a company, but it doesn’t encapsulate the entire picture. This is because market cap omits crucial details like a company’s outstanding debts and cash reserves.

While investors might use the enterprise value calculation to gauge a company’s scale and valuation, helping them make informed stock selections, combining an enterprise value formula with other valuation metrics is essential for a holistic view.

Two commonly used ratios are EV/Sales and EV/EBITDA. The former indicates a company’s cash flow, while the latter suggests its earnings before interest and taxes.

Frequently Asked Questions

What Is The Difference Between Enterprise Value And Equity Value?

Enterprise value represents a third party’s total price to acquire a company’s stock and assets.

For public companies, determining the enterprise value involves multiplying the current share price by the total number of outstanding shares and adding any outstanding debt. However, calculating the enterprise value for privately held firms is more challenging as the value of their stock is not readily apparent.

On the other hand, equity value represents the portion of a company’s overall value, known as the ‘enterprise value,’ that belongs to its shareholders. To calculate the equity value, start with the enterprise value, which is essentially the cost for a third party to purchase the company’s stock and assets.

From this, subtract any debt or equivalents, such as capitalized leases. Then, add back any excess cash or liquid assets the company possesses.

The resulting figure represents the total value available to the company’s shareholders, known as its ‘equity value.’